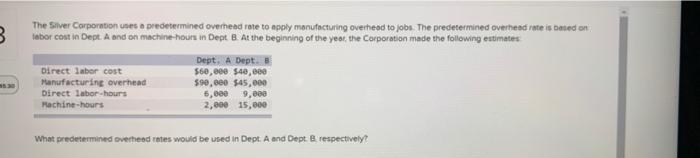

B The Silver Corporation unes a predetermined overhead rote to apply manufacturing overhead to jo...

Welcome to the discussion portal. A place to gain and share knowledge. Here you can ask questions and connect with people who contribute unique insights and quality answers. It is a place for people from around the world to ask and answer questions, and to learn from that process. Every piece of content on the site is generated by users, meaning it is created, edited, and organized by the same people that use the website.

Ask a Question Answer a Question

The International Accounting Standards Board is made up of members from the private sector and has no public sector involvement. Answer: True False?

(5 Marks)

QUESTION 2

Below is the partial statement of financial position of AXL Bhd as at 31 December 2017.

| Equity: | RM | |

| 10% cumulative convertible preference shares at RM10 per share; 1,000,000 shares authorised, 500,000 shares issued and outstanding | 5,000,000 | |

| Ordinary share capital valued at RM5 per share; 2,000,000 shares authorised, 1,000,000 shares issued and outstanding | 5,000,000 | |

| Retained earnings | 25,000,000 | |

| Total equity | 35,000,000 | |

| Long-term debt: | ||

| Convertible bonds payable (Issue A) | 6,000,000 | |

| Convertible bonds payable (Issue B) | 4,000,000 | |

| Total long-term debt | 10,000,000 |

Additional information:

REQUIRED:

| RM | |

| Net income | 7,500,000 |

| (-) 10% Convertible PS [10% x (----) x RM10 x ------] | (333,000) |

| Profit attributable to ordinary shareholders | 7,167,000 |

Shares= ------x 3 (share split) x 12/12 + ------x 6/12 = 3,150,000

BESP= ------/------= 2.28

(FILL IN THE BLANK)

Define recursion. Give an example recursive function definition. Compare recursion with iteration. Rewrite your recursive solution with iteration.