SubjectMate | Discussion

Welcome to the discussion portal. A place to gain and share knowledge. Here you can ask questions and connect with people who contribute unique insights and quality answers. It is a place for people from around the world to ask and answer questions, and to learn from that process. Every piece of content on the site is generated by users, meaning it is created, edited, and organized by the same people that use the website.

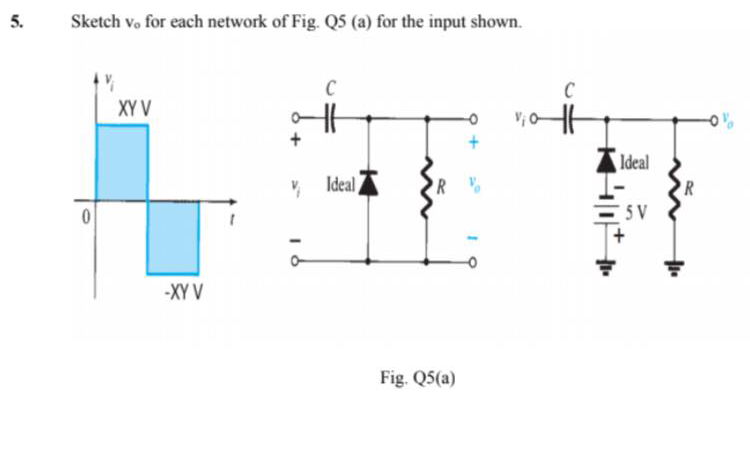

Ask a Question Answer a Question5. Sketch v, for each network of Fig. Q5 (a) for the input shown. с с XY V Ideal Ideal 'R 0 5V -X...

Hare X=1,Y=2

HOW CAN I SOLVE THIS?

For the network of Fig. Q2 (a), determine the range of Vi that will maintain VL at 8 V and not exceed the maximum power rating of the Zener diode.

For the network of Fig. Q2 (a), determine the range of Vi that will maintain VL at 8 V and not

exceed the maximum power rating of the Zener diode.

For the network of Fig. Q2 (a), determine the range of Vi that will maintain VL at 8 V and not exceed the maximum power rating of the Zener diode.

For the network of Fig. Q2 (a), determine the range of Vi that will maintain VL at 8 V and not

exceed the maximum power rating of the Zener diode.

Sketch vo for each network of Fig. Q5 (a) for the input shown.

Sketch vo for each network of Fig. Q5 (a) for the input shown.

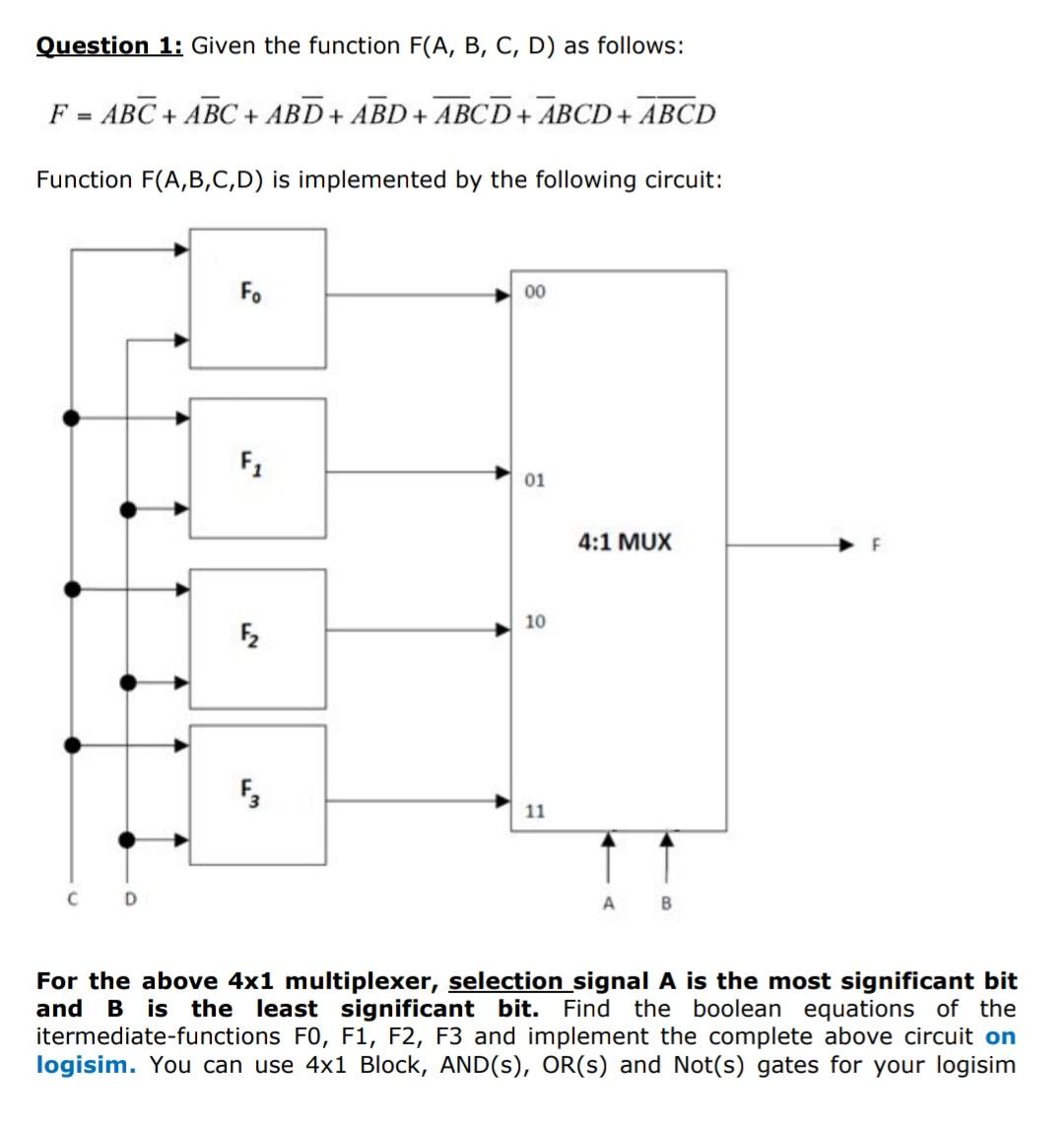

Question 1: Given the function F(A, B, C, D) as follows: F = ABC + ABC + ABD + ABD + ABCD+ĀBCD + ...

Please use logism to draw.

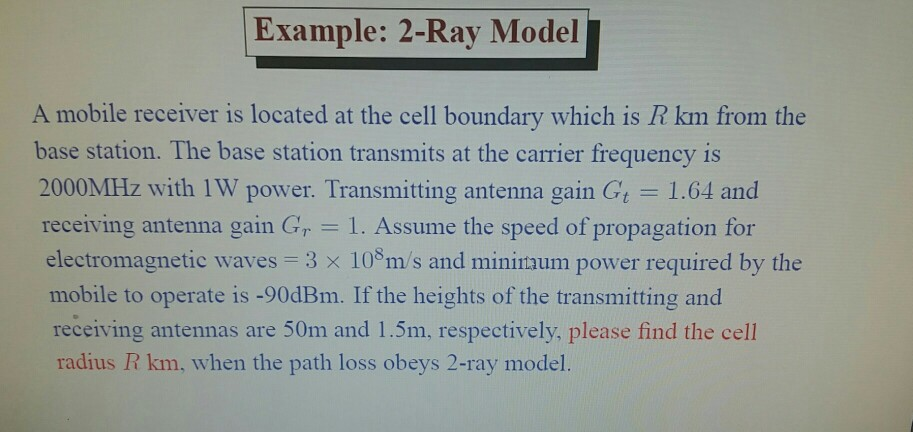

Example: 2-Ray Model A mobile receiver is located at the cell boundary which is R km from the bas...

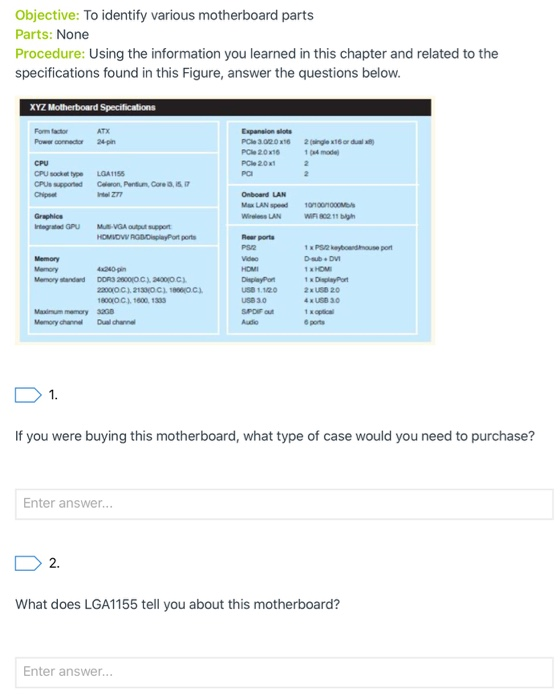

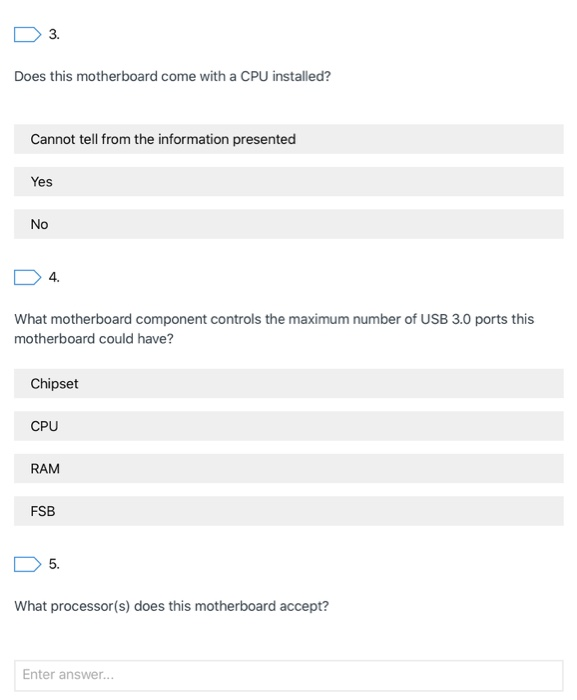

Objective: To identify various motherboard parts Parts: None Procedure: Using the information you...

Builtrite had sales of $700,000 and COGS of $280,000. In addition, operating expenses were calcul...

Builtrite had sales of $700,000 and COGS of $280,000. In addition, operating expenses were calculated at 25% of sales. Builtrite also received dividends of $50,000 and paid out common stock dividends of $25,000 to its stockholders. A long-term capital gain of $70,000 was realized during the year along with a capital loss of $50,000

Based on the above information, answer the following 4 questions:

1.What is Builtrite’s taxable income?

2. Based on their taxable income, what is Builtrite’s tax liability?

3.

If we add to our problem that Builtrite also had $10,000 in interest expense, which of the following statements is correct (assuming the same marginal tax rate of 39%)?3.

| Taxable income would increase by $10,000 | ||||||||||||||

| Taxable income would decrease by $10,000. | ||||||||||||||

| Taxable income would decrease by $6,100. | ||||||||||||||

| Taxable income would increase by $6,100 4. If Builtrite had experienced a long-term capital loss of $80,000 (instead of the $50,000 long-term capital loss stated in the problem), and still had the $70,000 long-term capital gain stated in the problem, which of the following is correct:

|