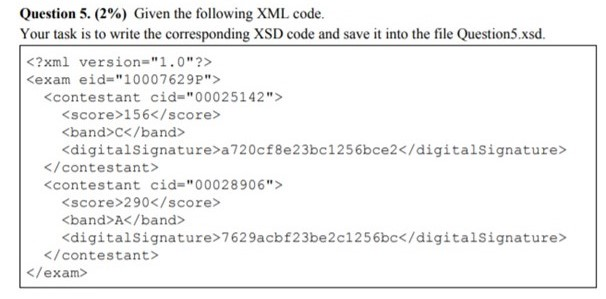

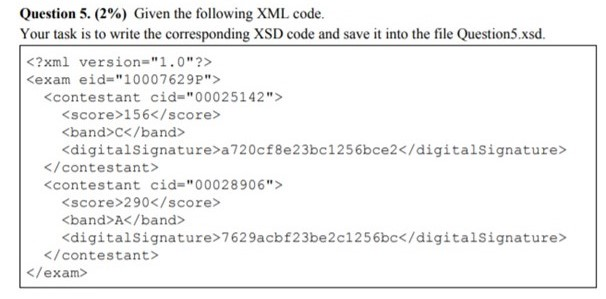

Question 5. (2%) Given the following XML code. Your task is to write the corresponding XSD code a...

Welcome to the discussion portal. A place to gain and share knowledge. Here you can ask questions and connect with people who contribute unique insights and quality answers. It is a place for people from around the world to ask and answer questions, and to learn from that process. Every piece of content on the site is generated by users, meaning it is created, edited, and organized by the same people that use the website.

Ask a Question Answer a Question

3.35) The motor A delivers 3000 hp to the shaft at 1500 rev/min, of which 1000 hp is removed by gear B and 2000 hp is removed by gear C . Determine (a) the maximum shear stress in the shaft; and (b) the angle of twist of end D relative to end A . Use G=12x10^6 psi for steel, and assume that friction at bearing D is negligible.

answer is a) A B -Tmax=10,030psi

BC -Tmax=9980psi

b)0.05289rad=3.03 degrees

| Dickinson Brothers, Inc., is considering investing in a machine to produce computer keyboards. The price of the machine will be $986,000, and its economic life is five years. The machine will be fully depreciated by the straight-line method. The machine will produce 31,000 keyboards each year. The price of each keyboard will be $30 in the first year and will increase by 4 percent per year. The production cost per keyboard will be $10 in the first year and will increase by 5 percent per year. The project will have an annual fixed cost of $206,000 and require an immediate investment of $36,000 in net working capital. The corporate tax rate for the company is 35 percent. The appropriate discount rate is 12 percent. |

| What is the NPV of the investment? (Do not round intermediate calculations and round your answer to 2 decimal places. (e.g., 32.16)) |

| NPV | $ |

| Suppose we are thinking about replacing an old computer with a new one. The old one cost us $1,320,000; the new one will cost, $1,580,000. The new machine will be depreciated straight-line to zero over its five-year life. It will probably be worth about $320,000 after five years. |

| The old computer is being depreciated at a rate of $264,000 per year. It will be completely written off in three years. If we don’t replace it now, we will have to replace it in two years. We can sell it now for $440,000; in two years, it will probably be worth $122,000. The new machine will save us $292,000 per year in operating costs. The tax rate is 35 percent, and the discount rate is 10 percent. |

| a.1 | Calculate the EAC for the old computer and the new computer. (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations and round your final answers to 2 decimal places. (e.g., 32.16)) |

| EAC | |

| New computer | $ |

| Old computer | $ |

| a.2 | What is the NPV of the decision to replace the computer now? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your final answer to 2 decimal places. (e.g., 32.16)) |

| NPV | $ |

1. Why it is so important for all application builders to always check data received from unknown sources, such as Web applications, before using that data.

2. Why should Web site operators that allow users to add content, for example forums or blogs, carefully and consistently patch and configure their systems?

A stock price is currently $36. During each three-month period for the next six months it is expected to increase by 9% or decrease by 8%. The risk-free interest rate is 5%. Use a two-step tree to calculate the value of a derivative that pays off (max[(40-ST),0])2 where ST is the stock price in six months.

Problem 2: Option Valuation (18 marks) In this question, you need to price options with various approaches. You will consider puts and calls on a share. Please read following instructions carefully:

• The spot price of this share will be determined by your student number. You need to use the last digit of your student number. The spot price of the share will be 56

• The strike price of the options will be the share price you just calculated +2. Strike Price is (56+2)=58.

Based on this spot price and this strike price as well as the fact that the risk-free interest rate is 6% per annum with continuous compounding, please undertake option valuations and answer related questions according to following instructions: Binomial trees: Additionally, assume that over each of the next two four-month periods, the share price is expected to go up by 11% or down by 10%.

a. Use a two-step binomial tree to calculate the value of an eight-month European call option using the no-arbitrage approach. [2.5 marks]

b. Use a two-step binomial tree to calculate the value of an eight-month European put option using the no-arbitrage approach. [2.5 marks]

c. Show whether the put-call-parity holds for the European call and the European put prices you calculated in a. and b. [1 mark]

d. Use a two-step binomial tree to calculate the value of an eight-month European call option using risk-neutral valuation. [1 mark]

e. Use a two-step binomial tree to calculate the value of an eight-month European put option using risk-neutral valuation. [1 mark]

f. Verify whether the no-arbitrage approach and the risk-neutral valuation lead to the same results. [1 mark]

g. Use a two-step binomial tree to calculate the value of an eight-month American put option. [1 mark] h. Calculate the deltas of the European put and the European call at the different nodes of the binomial three. [1 mark]

Critically evaluate your own managerial skills and explain with a reason / example:

1.2.1 A key feature of a manager that you possess that makes you an excellent

manager (2)

1.2.2 A key feature of a manager that you lack and could improve upon