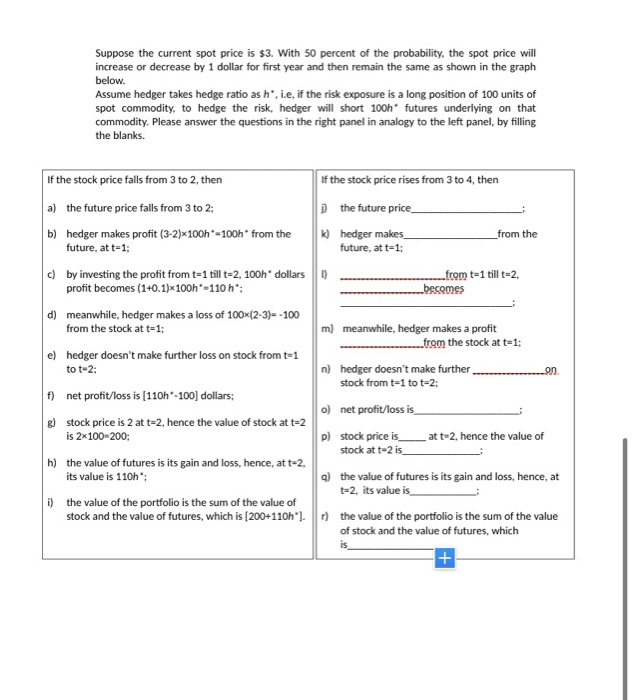

Assume hedger takes hedge ratio as h*, i.e, if the risk exposure is a long position of 100 units of spot commodity, to hedge the risk, hedger will short 100h* futures underlying on that commodity.

c) To make the hedge portfolio risk-free, the value of the portfolio should not vary no matter stock price rises or falls (or, equivalently, the hedge portfolio should not make profit in one state and make loss in the other, where the state means stock price rises or falls). Please based on the above fact, solve the optimal hedge ratio h*.

d) To make the hedge portfolio risk-free, the hedge portfolio should not make profit in one state and make loss in the other, where the state means stock price rises or falls. Please use the optimal hedge ratio solved in (c) to verify this fact.

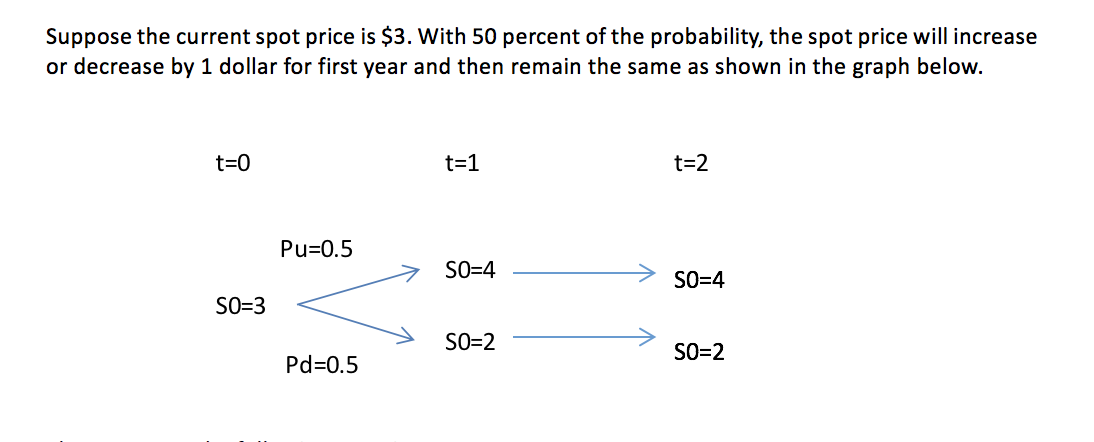

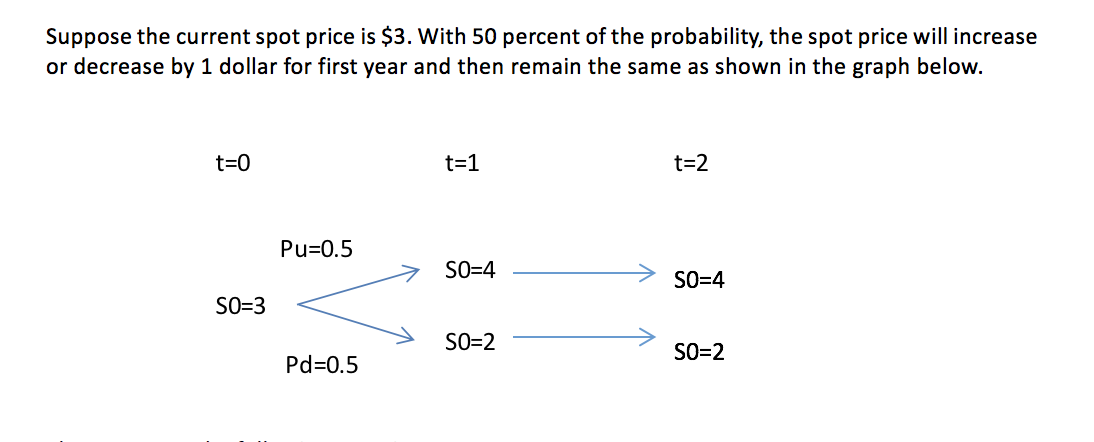

Suppose the current spot price is $3. With 50 percent of the probability, the spot price will increase or decrease by 1 dollar for first year and then remain the same as shown in the graph below. t=0 t=1 t=2 Pu=0.5 > S0=4 SO=4 SO=3 S0=3 < » SO=2 SO=2 Pd=0.5

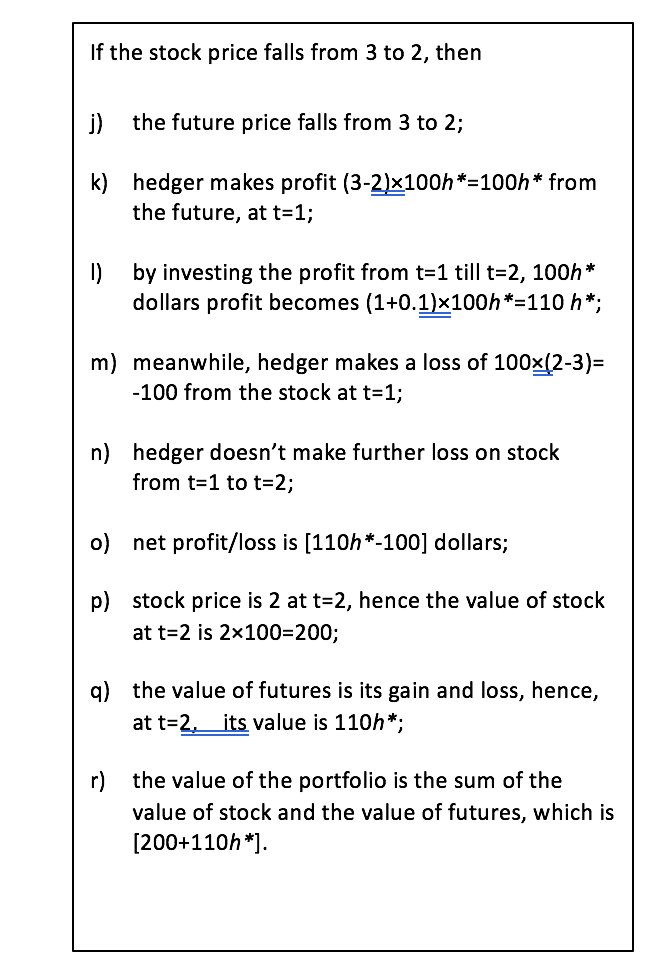

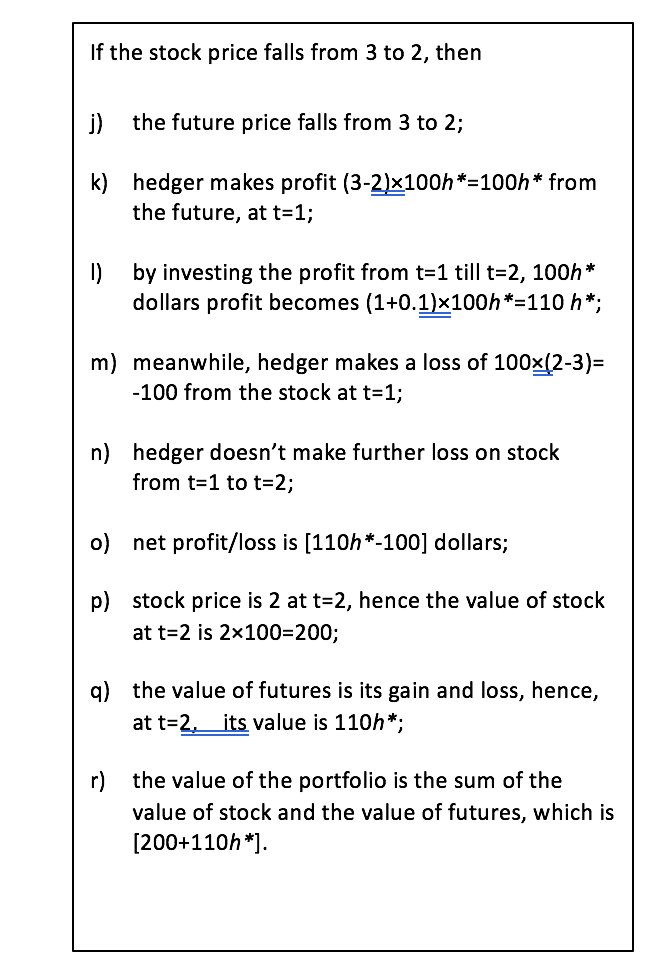

If the stock price falls from 3 to 2, then i) the future price falls from 3 to 2; k) hedger makes profit (3-2)x100h*=100h* from the future, at t=1; 1) by investing the profit from t=1 till t=2, 100h* dollars profit becomes (1+0.1)x100h*=110 h*; m) meanwhile, hedger makes a loss of 100x(2-3)= -100 from the stock at t=1; n) hedger doesn't make further loss on stock from t=1 to t=2; o) net profit/loss is [110h*-1000 dollars; p) stock price is 2 at t=2, hence the value of stock at t=2 is 2x100=200; q) the value of futures is its gain and loss, hence, at t=2, its value is 110h*; r) the value of the portfolio is the sum of the value of stock and the value of futures, which is [200+110h*].