Question 1 10 Marks 1.1. What will my investment of R100 500 be worth if my bank pays me simple i...

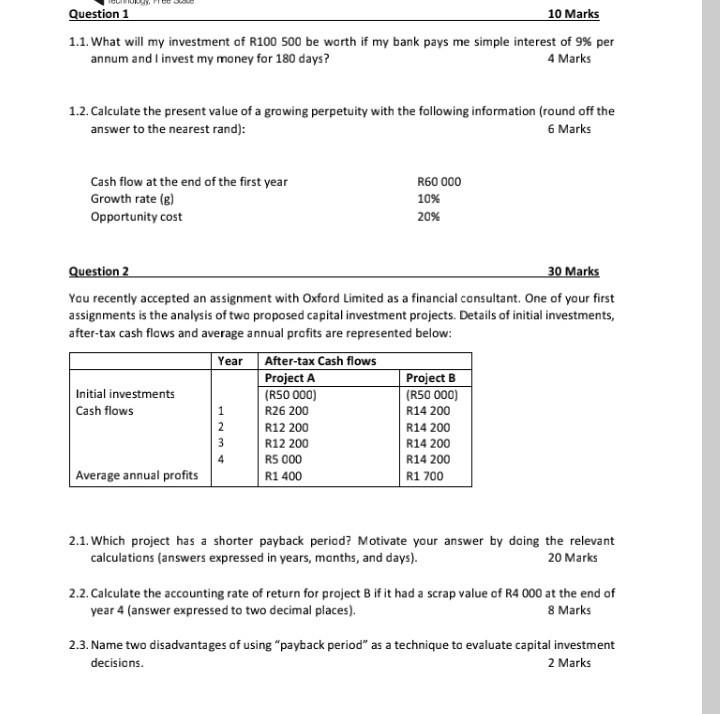

Question 1 10 Marks 1.1. What will my investment of R100 500 be worth if my bank pays me simple interest of 9% per annum and I invest my money for 180 days? 4 Marks 1.2. Calculate the present value of a growing perpetuity with the following information (round off the answer to the nearest rand): 6 Marks Cash flow at the end of the first year Growth rate (8) Opportunity cost R60 000 10% 20% Question 2 30 Marks You recently accepted an assignment with Oxford Limited as a financial consultant. One of your first assignments is the analysis of two proposed capital investment projects. Details of initial investments, after-tax cash flows and average annual profits are represented below: Year After-tax Cash flows Project A Project B Initial investments (R50 000) (R50 000) Cash flows R26 200 R14 200 R12 200 R14 200 R12 200 R14 200 RS 000 R14 200 Average annual profits R1 400 R1 700 1 2 ない 2.1. Which project has a shorter payback period? Motivate your answer by doing the relevant calculations (answers expressed in years, months, and days). 20 Marks 2.2. Calculate the accounting rate of return for project B if it had a scrap value of R4 000 at the end of year 4 (answer expressed to two decimal places). 8 Marks 2.3. Name two disadvantages of using "payback period" as a technique to evaluate capital investment decisions. 2 Marks

Solved

Supply Chain Management/Operations Management

1 Answer

Charlotte Quinte

Login to view answer.