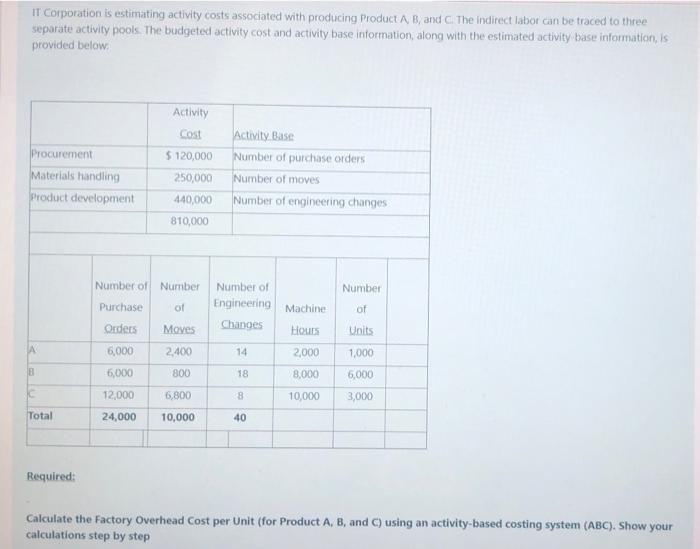

IT Corporation is estimating activity costs associated with producing Product A, B, and C. The In...

IT Corporation is estimating activity costs associated with producing Product A, B, and C. The Indirect labor can be traced to three separate activity pools. The budgeted activity cost and activity base information, along with the estimated activity base information is provided below Procurement Materials handling Product development Activity Cost $ 120,000 250,000 440,000 810,000 Activity Base Number of purchase orders Number of moves Number of engineering changes Number of Number Number o1 Number of Engineering Changes Machine Purchase Orders of Hours Units Moves 2,400 14 B 6,000 6,000 12,000 800 18 2,000 8,000 10,000 1,000 6,000 3,000 C 6,800 8 Total 24,000 10,000 40 Required: Calculate the Factory Overhead Cost per Unit (for Product A, B, and C) using an activity-based costing system (ABC). Show your calculations step by step

Solved

ACCOUNTING

1 Answer

Kessario M

Login to view answer.