Assume hedger takes hedge ratio as h*, i.e, if the risk exposure is a long position of 100 units ...

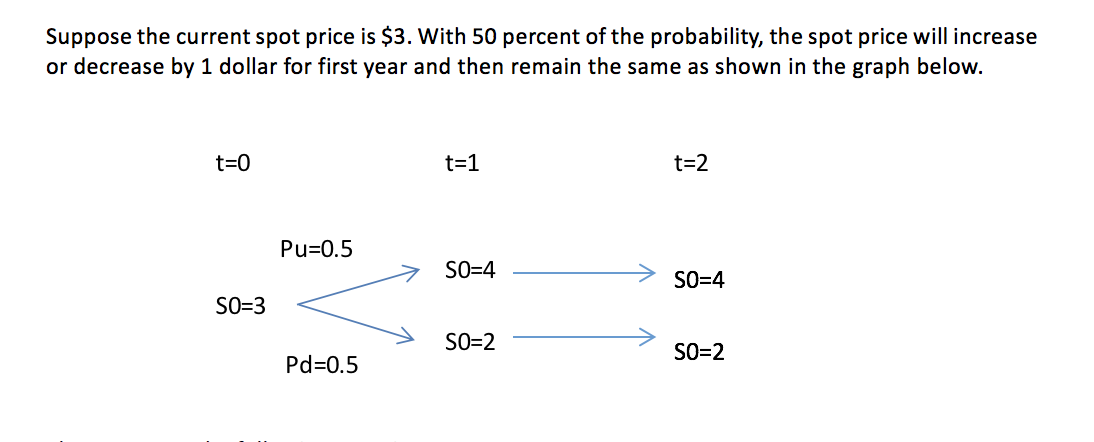

Assume hedger takes hedge ratio as h*, i.e, if the risk exposure is a long position of 100 units of spot commodity, to hedge the risk, hedger will short 100h* futures underlying on that commodity.

c) To make the hedge portfolio risk-free, the value of the portfolio should not vary no matter stock price rises or falls (or, equivalently, the hedge portfolio should not make profit in one state and make loss in the other, where the state means stock price rises or falls). Please based on the above fact, solve the optimal hedge ratio h*.

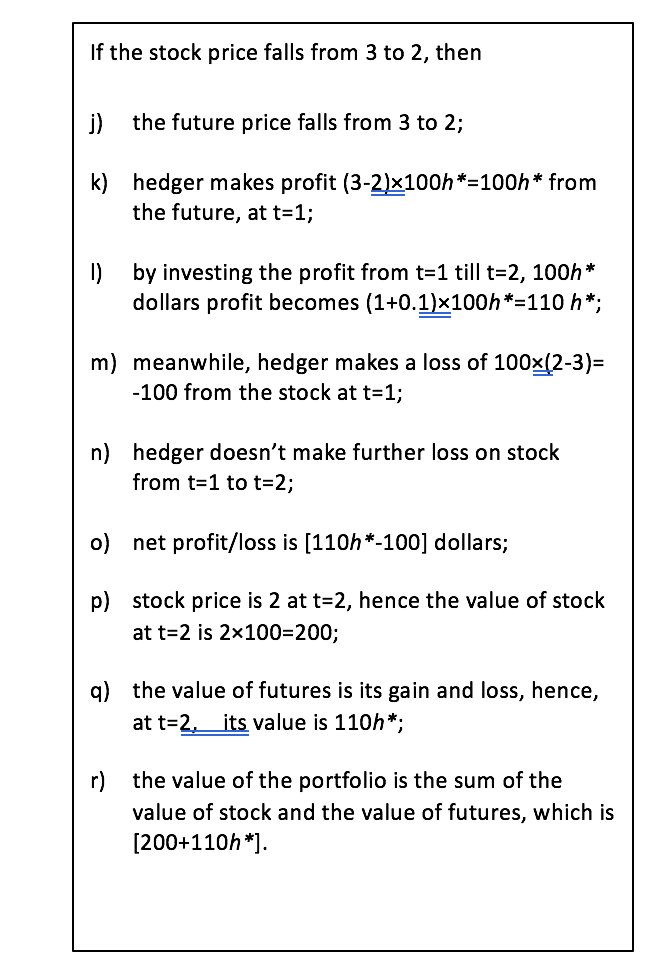

d) To make the hedge portfolio risk-free, the hedge portfolio should not make profit in one state and make loss in the other, where the state means stock price rises or falls. Please use the optimal hedge ratio solved in (c) to verify this fact.

Login to view answer.